There is

nothing quite like a league table to focus minds. I know this through my

intimacy with university league tables, noting Shropshire’s recent success on

this front as Harper Adams University ascended to the lofty heights of No.1

‘Modern University of the Year’, and the top 50 overall, in The Times and Sunday Times Good University

Guide; whilst also being the second fastest riser in the Complete University Guide. Once we –

people, companies, universities, football teams – are ranked alongside each other,

it invokes our inherent competitiveness, one of the key drivers of

productivity.

Which is why –

as the self-declared Bad Boy of

Benchmarking – I could not pass over the SME Export Track 100, published by The Times in February 2017, without getting the competitive juices

flowing. This particular league table ranks the top 100 UK SMEs by their rate

of export growth over a two-year period.

PROBLEM

The interactive map below pinpoints each of the companies in the top 100, showing that there was not one Shropshire company in the rankings. There were nine Midlands companies, including two from the Black Country – one of which, Stiltz Lifts in Kingswinford, came 7th overall – and one from Staffordshire. Six of the top 100 are from the West Midlands which, given that the region contributes 7.3% of national Gross Value-Added (GVA), is not too bad. London is, of course, a hotspot, along with a ring around the M25 that encompasses the wider South East. Also the North West, around Manchester; Yorkshire, close to Sheffield and Leeds; Glasgow; and a half circle around the south of Birmingham.

In fact, Shropshire hasn’t had a company crack the top 100 in any of the last four years. Not since Treadsetters came 59th in 2013, Newport Paper came 89th in 2012, and Rea Valley Tractors did fantastically well to pace the Midlands and come 7th overall in 2010, the ranking’s inaugural year. Further, in the few years when they published a top 200, Nexus Industries (Luceco PLC) came 139th in 2013, Grainger & Worrall came 127th in 2014, and Belton Cheese came 135th in 2016. Fantastic examples, and Shropshire flagbearers, all.

But that’s history, now we need to put Shropshire back on the export map; and, through my export market intelligence cycle, I’ve got a proposal as to how to kick start that exercise.

Part of the problem is acknowledging that nearly half of SMEs have identified market intelligence as a challenge to exporting, the second most significant factor; while the OECD reported that SMEs found, “identifying foreign business opportunities”, and, “limited information to locate/analyse markets”, to be the second and third most significant barriers. I want to work with Shropshire companies to tackle these barriers, in order to achieve export growth.

SOLUTION

Engaging in a comprehensive export market intelligence exercise can not only overcome these barriers but, more ambitiously still, it can identify the best opportunities for export growth, prioritise investment and minimise risk. The Challenger MI Export Market Intelligence Cycle (below) broadly has seven stages, and fuses an array of data: from a company’s own sales and CRM data, to commodity-level trade data, macro-economic data, primary research, and the expertise held within the company itself.

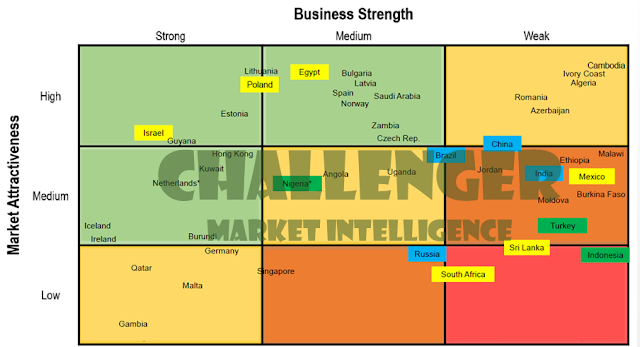

The first two stages analyse a company’s own data and global trade data to evaluate all global markets, and benchmark those against a company’s existing markets and any other targets already identified. These are plotted on the ‘Export Screen Matrix’ (adapted from the GE-McKinsey Business Screen), using fixed parameters along the X and Y axes (e.g. market size, growth, share), and resulting in a long-list of prioritised opportunities. The example on the diagram – shown in more detail below – is a useful one, because it plots the company’s current markets (yellow), against typical targets such as the BRIC countries (blue) and the MINT countries (green), before evaluating these against other, previously unacknowledged, opportunities.

There are important findings in this example: of the existing markets, three should be capitalised upon, with a view to increased investment, and three reviewed, with a view to divestment; while none of the BRIC or MINT countries – acronyms that now roll of the tongue of any Financial Times reader when talking about potential export markets – makes it into a green segment. In the pursuit of export growth, the matrix clearly indicates where this client should invest its time, effort and budget.

In my experience, the best opportunities are rarely those that would immediately spring to mind. In recent months, I have identified Vietnam and the Czech Republic (Czechia) as being among the best opportunities for a technology company; with Lithuania, Zambia and Guyana as great opportunities for a fertiliser company.

Lots of opps. in Vietnam - did research for an export strategy for a client recently & #Vietnam was in the top 10 target markets. 🇻🇳🇬🇧📈🌍 https://t.co/af7idfxLGQ— Challenger MI (@Challenger_MI) February 27, 2017

GROWTH

The key link between this and Shropshire’s ambitions for the SME Export Track 100 is that, given the league table measures export growth (not total volume), this market intelligence approach enables us to align a company’s export strategy with the best growth markets. This is done by giving market growth a heavier weighting along the Y axis of the ‘Export Screen Matrix’, which is perfectly appropriate for SMEs as medium-sized high-growth markets are likely to present better opportunities than the overall largest markets.

PROPOSAL

With Brexit, and a weaker pound, opportunities for export growth abound. But companies need to pick a prosperous path through the global economy – which is tumultuous and ever-changing – by pinpointing the best growth opportunities, and that is what the Challenger MI approach is intended to do.

Shropshire is a ‘Challenger Brand’ – a county often overlooked on the national scene, but one that is capable of punching well above its weight. Challengers have to work harder and smarter, and I believe that this intelligence-led approach to pursuing export growth can be the basis for Shropshire companies mounting that challenge.

This methodology can help propel a Shropshire company back into the SME Fast Track 100 for the first time in five years; and especially so alongside the support of associated experts in the county: export consultants, freight forwarders, overseas marketers, and, of course, the expertise within the companies themselves. One of the West Midlands firms that does make the top 100 this year, Gymshark in Redditch, not only employs a Market Analyst, but is currently recruiting for another one too.

As a consultant Market Analyst, I would like to work with local Shropshire companies that are ambitious enough to set cracking the SME Export Track 100 as a target, and that would like to explore how market intelligence can help achieve it. In addition, I would like to partner with other local organisations that can help facilitate export success – freight forwarders, export consultants, and overseas marketing experts in particular.

Let's do this! If you come close to the criteria below, and think that I can help you achieve the second and third points, then contact me here.

No comments:

Post a Comment